SCROLL

COVER STORY

Buried Gold: Leveraging the Inflation Reduction Act to Support Electrification

The Inflation Reduction Act of 2022 (IRA) provided $369 billion in funding for climate and energy provisions, making it the single largest investment in energy innovation and infrastructure in American history.

SCROLL

The Inflation Reduction Act of 2022 (IRA) provided $369 billion in funding for climate and energy provisions, making it the single largest investment in energy innovation and infrastructure in American history.

Signed into law on Aug. 16, 2022, the bill provides tax incentives for renewable energy, energy efficiency, and electrification designed to help individuals and organizations take steps to reduce greenhouse gas emissions and improve infrastructure resiliency.

Most importantly, the IRA provides funding streams for both taxable and tax-exempt entities to finance renewable energy projects and achieve net-zero or carbon-reduction goals. The law also offers new avenues for tax-exempt entities to invest in energy projects and take advantage of investment tax credits. Historically, these organizations were not eligible for such incentives.

Many tax-exempt entities have announced strategic decarbonization efforts or committed to net-zero goals that will require significant investment and new ways of thinking in the coming years. If an organization is targeting net zero by 2030, 2040, or 2050, the systems installed today must be aligned with those goals. Financial incentives from the IRA can support these efforts.

TABLE 1. When evaluating geothermal systems for a specific project, careful consideration of first cost, life cycle cost (cost to maintain), and deferred energy/utility costs must be considered.

Data courtesy of HEAPY

Incentives for Geothermal Systems

In particular, the IRA provides significant incentives for both taxable and tax-exempt entities to install geothermal systems.

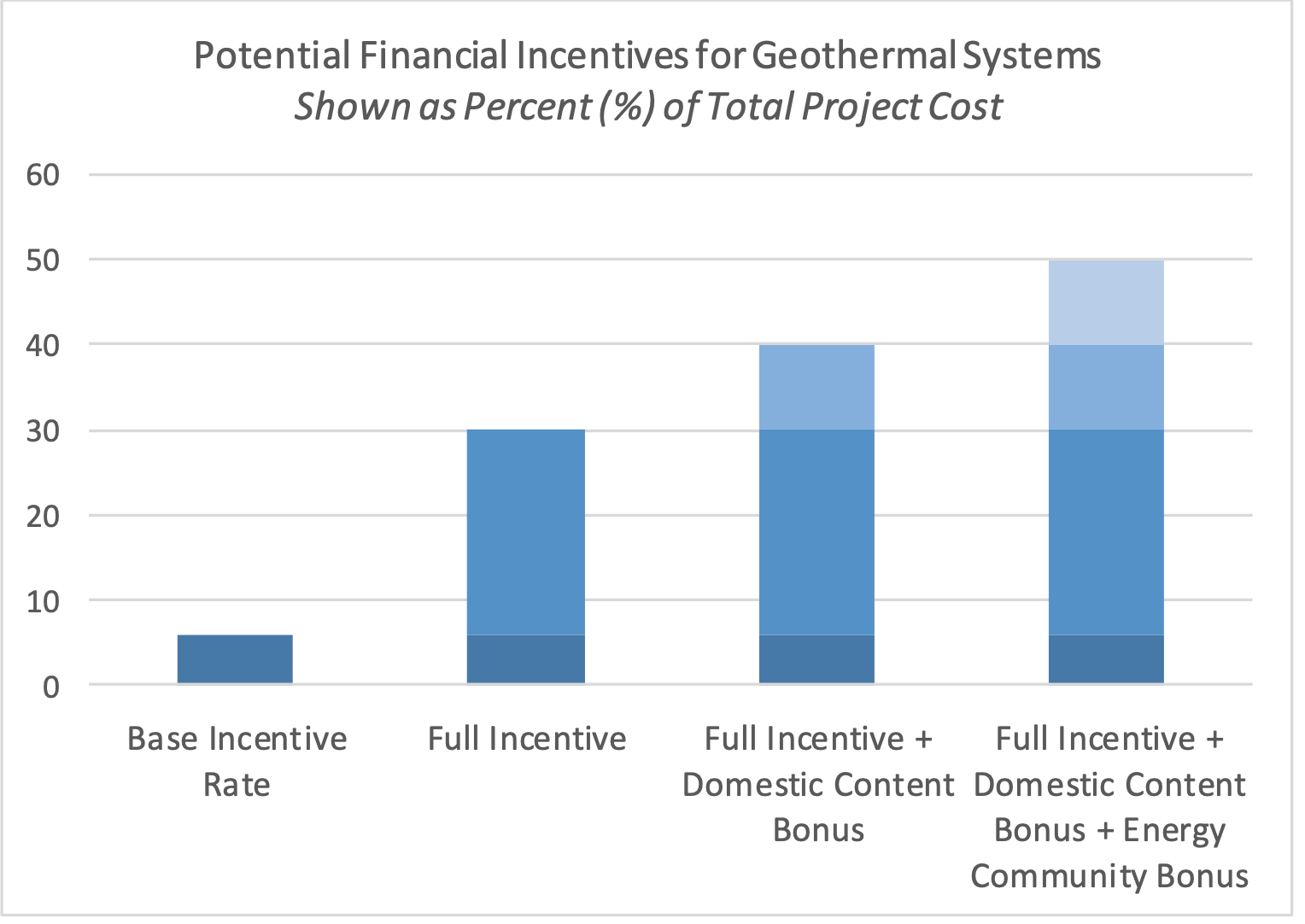

Under the IRA, geothermal systems may now qualify for a 30% federal investment tax credit (previously 10%). The incentive is calculated using a set base rate (6%) and can be increased up to five times the base rate for projects that meet certain requirements for prevailing wage and apprenticeship requirements determined by the U.S. Department of Labor.

Prevailing wage and apprenticeship labor percentage requirements are waived for projects with a maximum net energy output of less than 1 MW. The IRS provides additional guidance on specific provisions of the law as it is being implemented.

The IRA also offers several unique bonus incentives for organizations meeting the following criteria:

- Domestic Content Bonus: A 10% bonus incentive for facilities where 100% of the steel or iron components and 40% of their manufactured product components are produced in the U.S.; and

- Energy Community Bonus: A 10% bonus incentive addition for projects located in communities, such as brownfield sites, fossil fuel employment driven areas, or coal communities.

If a geothermal project qualifies for the full incentive and the bonus incentives, it could receive up to 50% in financial incentives. In some cases, and even more exciting, these financial incentives could apply to components tied to the geothermal system. Geo field and inside building costs, such as ductwork, piping, heat pumps, and chillers, could also be covered at up to 50%.

This is an unprecedented financial windfall for organizations seeking to invest in innovative technology to help achieve energy efficiency; net-zero; or environmental, social, and governance (ESG) goals. Understanding how these incentives apply to a proposed project could determine whether the project is financially viable.

Direct Pay: A Game Changer for Nonprofits

Perhaps the most intriguing portion of the IRA is its allowance for credit monetization or the direct pay provision. The provision allows tax-exempt organizations to receive these incentives as direct payments, creating potential funding for projects that were not previously viable. (Taxable entities can only take advantage of the direct pay provision in specific circumstances, such as for the clean hydrogen production credit or advanced manufacturing credit.)

MACR & ACCELERATED DEPRECIATION

In addition to the tax incentive provisions offered by the Inflation Reduction Act for geothermal systems, taxable (for-profit) entities can take advantage of the modified accelerated cost reduction system or accelerated depreciation. This further improves the short-term payback and financial viability of geothermal installations.

FIGURE 1. Ohio State University’s South High Rise renovation and addition leverages a closed-loop geothermal central heating and cooling plant that includes 410 wells that are 550 feet deep.

Image courtesy of Brad Feinknopf/OTTO

This provision is a game changer for nontaxable entities, such as health care systems, schools and universities, faith organizations, and local governments and municipal utilities, that have historically been excluded from these types of financial incentive programs.

Tax-exempt entities are eligible for direct payments of the investment tax credit (ITC) when they finance a geothermal capital project, meaning these organizations could receive up to 30% of the cost of the project paid directly from the U.S. Department of the Treasury.

FIGURE 2. Ohio State University’s South High Rise central plant provides 3,200 tons of cooling and 40,000 Kbtu/Hr of heating and uses 31% less energy. HEAPY conducted a detailed energy analysis and life cycle cost study to validate the return on investment for the project.

Image courtesy of HEAPY

There is a caveat: The IRS has not yet issued guidance on direct pay provisions, meaning documentation requirements as well as when a payment would be issued is still unclear. Organizations should examine options now and look for final guidance from the Treasury Department to ensure they fully understand potential incentives and how they apply to a particular geothermal project.

Prior to the IRA, federal, renewable energy tax credits were only available to entities with a federal tax liability. Non-taxable entities can now explore decarbonization solutions, like geothermal, via direct ownership, and these incentives can reduce a geothermal systems simple payback horizon from 10-20 years to zero to five years, depending on how quickly the direct pay incentives are received.

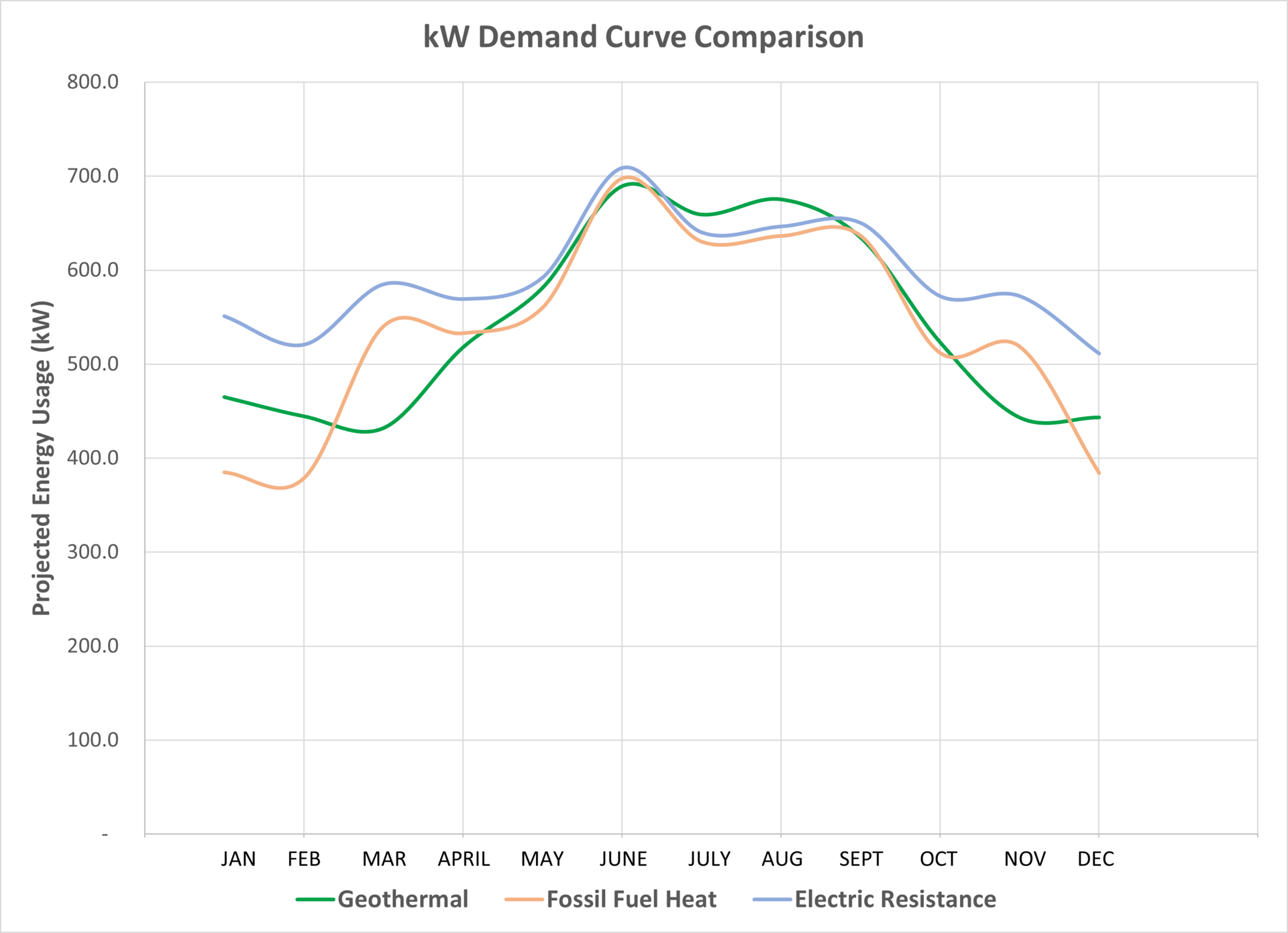

FIGURE 3. A demand curve comparison chart based on data gathered using a predictive model.

Data courtesy of HEAPY

Benefits of Geothermal Systems

First and foremost, geothermal is proven renewable energy technology with a 118-year track record of successful implementation and installation (first installed in Italy in 1904). Geothermal systems are among the most energy-efficient systems in existence today, according to the U.S. Environmental Protection Agency (EPA), capable of helping organizations reduce long-term energy usage and decrease fossil fuel consumption, particularly in parts of the country with cold winters.

Geothermal systems are also resilient and dependable. They heat using the constant thermal energy of the Earth in the winter and then cool by using it as a heat sink in the summer, remaining unaffected by changes in weather. In this way, geothermal is superior to air-source heat pumps year-round, which could still require fossil fuel, electric resistance heat support, or backup for very cold days of the year. These systems can be excellent solutions for organizations trying to electrify their buildings, particularly in states with colder seasonal temperatures.

And, resiliency matters. The frequency of blackouts has increased dramatically in the past decade, with the average American experiencing eight hours of power outages in 2020, a rate that has more than doubled since 2015, according to the U.S. Department of Energy (DOE). This trend is primarily driven by major weather events, which are becoming more common due to climate change.

Geothermal systems offer organizations an opportunity to own and operate their own on-site renewable energy sources, minimizing the impact to the electrical grid as geothermal systems minimally impact peak demand on the electrical power grid during the coldest months of the year, a challenge that will become more salient as the country continues to electrify facilities and infrastructure.

FIGURE 4. HEAPY installed a closed-loop geothermal system for a new 30,000-square-foot medical office building located in Zanesville, Ohio. The 25 wells, each 300 feet deep, were installed under the parking lot.

Image courtesy of HEAPY

Selecting the Proper Solution

Geothermal isn’t right for every organization, but a variety of applications and configurations are available to fit different site conditions.

An open-loop geothermal system pumps groundwater from a nearby aquifer to an indoor heat pump and then discharges water back into an approved drainage area. Open-loop systems can be excellent solutions in locations with plentiful, high-quality ground water. They require less upfront investment but require more maintenance and upkeep.

Open-loop systems require less space to install, so they can sometimes be solutions for facilities in crowded urban environments. These systems also introduce a certain level of risk for environmental contamination due to their impact on groundwater. Some municipalities restrict open-loop geothermal systems for this reason.

A closed-loop geothermal system is often best considered for new construction or when an organization is looking to replace an existing system that has reached the end of its useful life. Closed geothermal systems are less reliant on groundwater and geography but sometimes require more space to construct and install.

For example, HEAPY installed a closed-loop geothermal system in a new, 30,000-square-foot, medical office building located in Zanesville, Ohio. The 25 wells, each 300-feet deep, were installed under the parking lot, a creative solution that allowed enough space for the system to be viable in both installation cost and energy output.

Closed-loop geothermal systems also require a greater upfront investment. However, once installed, a closed-loop geothermal system often requires very little maintenance and generally presents the lowest system operating cost. These systems can last for decades, perhaps even 100 years, and will become fixtures on the properties, providing reliable, renewable energy for generations.

When evaluating geothermal systems for a specific project, careful consideration of first cost, life cycle cost (cost to maintain), and deferred energy/utility costs must be considered.

Conclusion

The IRA financial incentives for geothermal systems are currently in place until 2032, providing longevity and more predictability for the market to grow and support additional capacity for geothermal projects going forward. The impact of the bill will be felt for decades, driving accelerated adoption of geothermal systems as well as other renewable energy and electrification technologies.

With proper planning and the right conditions, geothermal is a proven technology that can reduce emissions and help institutions achieve net-zero targets, particularly in colder climates. An investment in renewable energy and geothermal systems will make an impact for decades and help reduce long-term utility costs. And, through the IRA, there is no better time to invest than now.

Brianna Wooten, director of marketing, HEAPY, contributed to this article.

Jeremy Fauber, P.E., CGD, LEED AP BD+C

With 19 years of innovative and sustainable design experience, Jeremy Fauber serves as the manager of engineering and digital strategy at HEAPY. His past work includes corporate, health care, education, and mission critical facilities with budgets exceeding $250 million. He is passionate about delivering projects that balance first cost and life cycle cost as well as resiliency and energy usage. Fauber has served on multiple ASHRAE standards committees, including as chair of Standard 170, "Ventilation of Health Care Facilities," and as a voting member for Standard 189.3, "Design, Construction, and Operation of Sustainable High-Performance Health Care Facilities." He is a past president of the ASHRAE Dayton Chapter.